Podcast on exit taxation - "Goodbye Germany"

Relocation taxation: What you need to consider for tax purposes if you want to leave Germany permanently!

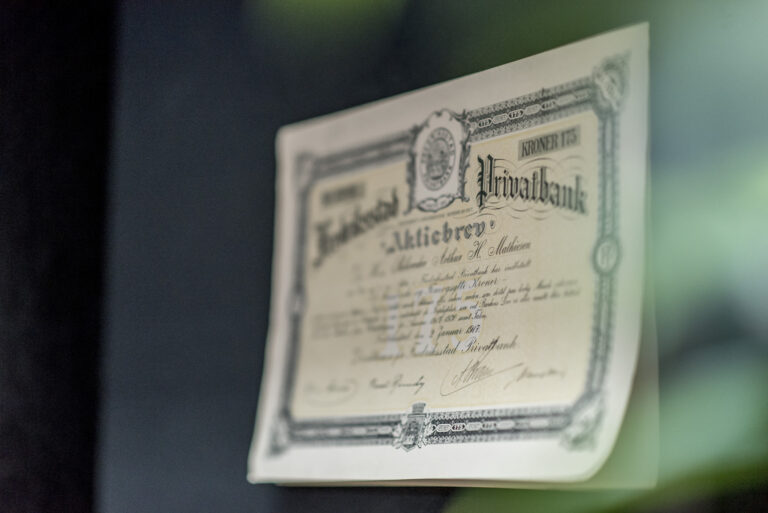

Goodbye Germany! Emigrating is not so easy, at least if you have a stake of more than 1% in a corporation. This is where exit taxation applies(§ 6 AStG)!

In the “CFO Insights” podcast with Daniel Winkler from Dawicon, I discussed what relocation management is and what needs to be considered.

Have fun listening!

You can also read more about this topic here!

You are currently viewing a placeholder content from Default. To access the actual content, click the button below. Please note that doing so will share data with third-party providers.

More InformationAre you planning to move away and need tax advice?

I am happy to support you in the following areas:

- Checking the requirements for exit taxation

- Arrangements to avoid exit taxation

- Assistance with appeals and lawsuits before the tax courts in connection with exit taxation

- Expert opinion on individual questions of exit taxation

Please feel free to contact me!

Disclaimer

This article does not constitute legal or tax advice, but is for general information purposes only. Every situation is individual, so I always recommend professional advice to avoid tax disadvantages.

The article uses simple language for better understanding and is also abbreviated with regard to the individual conditions required by law.

Last updated 07.03.2023